“…the line between public and private markets continues to blur.”

Shorting Startups

// This week The Wall St. Journal highlighted hedge fund Apeira Capital in their article Overvalued Startups Could Be ‘Shorted’ by New Firm. It explains how Apeira plans to essentially create a long/short strategy going long Series A to C companies and then create “venture synthetics” and go short overvalued companies. I would assume they would be selling the late-stage companies, so in a way, they’d be going long a time spread (more on that down the road), but I digress.

Short selling is a touchy subject in the public market, and even more so in the private market, so I’ll tread lightly. Real quick, shorting is when an investor borrows stock from someone who owns it (for a fee) and then sells that stock, she/he then benefits if the stock goes down, but is on the hook if the stock rises. Because the said investor is betting against a company’s stock, there’s a negative connotation that comes with this strategy. Nobody likes the person who cheers when you lose your parlay on a back door cover.

Really, it’s a bit of a naive and lazy argument to say “shorts” are bad. Not all shorts are bad, just like not all longs are good. Is it okay for a company like Wirecard and its executives to make billions from public investors? Some refer to short sellers as financial detectives that play an important role in investor protection. They aren’t afraid to go against the herd and ask the hard questions. The SEC actually is more reactive than proactive when going after cases and rely on people from the short side to do some of the due diligence.

In addition to going short a company because of potential fraud or just because a company might be overvalued, there are other reasons why a fund would need to short a stock, for example hedging its portfolio, options, or convertible bonds. Because a fund is able to short, the market is more liquid and efficient. Perhaps that fund can now buy more individual stocks because it can short an index.

In regard to the private markets, obviously, it’s an opaque and inefficient eco-system where true value is hard to decipher. It’s one built on grand narratives and hopes of building something great. Venture capital and the entrepreneurs they invest in create more value than they take away 1000x over, and I hope they succeed. But it’s okay to be skeptical every now then.

There are people with not the best of intentions in the private market, just like every other industry in the world. There will also be some companies that will take advantage of “staying private longer” and inflate their valuation before being dumped on the public market investor. So why not have more “financial detectives” at the earlier stage?

I hope Apeira is successful in its strategy. It may come across as cynical when in truth, I believe with a more liquid and efficient private market the overall pie will grow and create more opportunity for both investors and founders. The private market needs to continue its momentum, however, if more frauds (a la Theranos) slip through the cracks or the new IPO darlings start to drastically underperform, the private market is going to retract and will need to rebuild trust amongst all investors, so maybe, by Apeira shorting the market, it’s actually helping it go up.

Short Selling Interviews & Research

// If you’re new to short selling or want a better understanding of exactly how it works, I’ve gathered a few resources that might help:

A good place to start is with Ihor Dusaniwsky’s, Managing Director of Predictive Analytics for S3 Partners, interview on Meb Faber’s podcast #262. A lot of detail in this conversation that explains what the short selling/lending business is and some of the strategies that can be deployed.

I like this guy a lot. Edwin Dorsey from The Bear Cave writes about potential corporate malfeasance and the short selling world. He was just on the Pomp Podcast #442.

Alex Danco talked with Kris Bennatti, the founder & CEO of Bedrock AI, about fraud.

Marc Rubenstein, who is starting to become my go-to Substack financial newsletter, talks about fraud and Wirecard back in June.

Financial history analyst Jamie Catherwood writes about the history of short selling in his newsletter Investor Amnesia.

Finally, to better understand investors who short stocks and hear their perspective as to why and how, Real Vision recently interviewed Mark Hiley, founder of The Analyst, in Tales From the Frontlines of Short Selling, and also the most well known short seller Jim Chanos in TAMSanity and the Golden Age of Fraud.

Private & Public Price Action

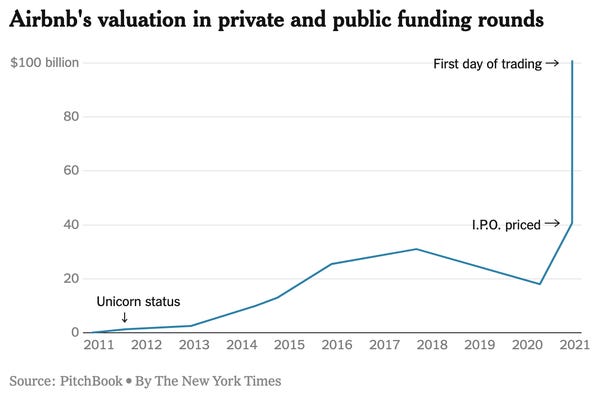

// Crazy price action in the private/public world lately. Did Airbnb and DoorDash just top tick the market or just an inflection point and the beginning of the next leg up?

I’m neither here nor there, but as I’ve learned it’s futile to fight the tape. Rather than pontificate on what has happened, or what will happen, I’ll defer to the experts:

‘This Is Insanity’: Start-Ups End Year in a Deal Frenzy (NYT)

The Limits of Airbnb's Rebound (Axios)

Airbnb, DoorDash Rallies Stoke Debate on Pricing IPOs (Bloomberg)

DoorDash Trading at Steep Premium to Uber and GrubHub (CNBC)

Early DoorDash Makes the Case For 10x Growth From Here (TechCrunch)

Don’t Buy DoorDash Stock; It’s the WeWork of 2020 (FoxBusiness)

Marketplaces to Know

// Though I spend most of my time on private and public equity, my main goal is to not only shed some light but also to learn more about this ‘new market’ and then hopefully find opportunity within. This market also includes all the alternative investments that are becoming more accessible. There are the obvious ones like equity, debt, and real estate but you’re starting to see a ton of momentum in cars, collectibles, art, shoes, trading cards, wine, etc. I wanted to revisit the trend because two platforms that are sourcing and curating these alternative investments announced new rounds of funding this week.

Vincent, from Indiegogo founder Slava Rubin, publicly launched this week announcing it has raised $2 million. Vincent is a “kayak-like” alternative investments discovery platform.

Rubin talked with YahooFinance where he echos a lot of the private market mantras (access, low-interest rates, opaque markets, new opportunities) and explains how and why they are “looking to build the largest database of alternative investments on the internet.”

__________

Catawiki an online auction platform based out of the Netherlands raised $182 million from private equity firm Permira’s ‘Growth Opportunities Fund’ with participation from Accel.

“Catawiki, which calls its platform a ‘curated online marketplace for special objects,” was founded back in 2008 and now boasts over 10 million users. The company says it now employs more than 240 in-house experts who are specialized in collectibles, art, design, jewelry, watches, classic cars, and more, and that 65,000 special objects are put up for auction on its platform on a weekly basis.”

__________

Related podcast: Super interesting discussion from a16z about NFT’s, or non-fungible tokens, but also covers dynamic pricing and trading of a digital art “stock market” which could be the precursor or a model for trading other types of assets. Artists Pak and Signe Pierce joined Zoran Basich to talk Crypto for Creators: From Art Galleries to ‘Tokenized’ Collectibles.

“The big picture is that emerging “tokenization” models, including non-fungible tokens, or NFTs, are creating new ways for collectors and investors to buy, sell, and trade digital art. More broadly, these innovations open the door to the tokenization of any products or collectibles that can be captured and owned digitally, and many new business models for creators.”

Bitcast Clips:

Signe compares the price of her work to that of a stock price.

Basich talks about dynamic pricing and trading digital art.

Private & Public News From the Week

// Private

Snowflake Ventures Makes Its First Investment In DataRobot (VentureBeat)

A $100 Billion Valuation Poses Risk For Fintech Star (Bloomberg)

Roblox Delays IPO Until Next Year (WSJ)

Tech IPO Bonanza Yields Riches for Venture-Capital Firms (WSJ)

Sequoia Capital Warned of a ‘Black Swan.’ Instead, 2020 Is One of Its Best Years Ever (Bloomberg)

// Public

The Essex Boys: How Nine Traders Hit a Gusher With Negative Oil (Bloomberg)

Hedge Funds Love SPACs But You Should Watch Out (Bloomberg)

BlackRock’s Fink Says IPO Fever Could End in ‘Many Accidents’ (Bloomberg)

SoftBank Is Discussing a ‘Slow-Burn’ Buyout to Go Private (Bloomberg)

SoftBank’s Rocky Year Ends on a Winning Streak (WSJ)

Some Small Hedge Funds Reap Big Gains in Tough Times (WSJ)

Microsoft Doubles Its Money After Backing C3.ai As It Goes Public (CNBC)

Thank the Fed for the Stock Market’s Run, and the Plodding Pace to Come (WSJ)

The Valuation Warning Signs for Stock Markets (FT)

Data

// Visual Capitalist puts out some awesome content. A few weeks ago they highlighted the 6 Powerful Signals That Reveal the Future Direction of Financial Markets.

Their first signal is ‘700 Years of Falling Interest Rates.’

// Thanks.

This newsletter is created and authored by Bryce Tolman and is published and provided for informational purposes only. The information in the newsletter constitutes the Author’s own opinions. None of the information contained in the newsletter constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Author is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the newsletter may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.